MeetingMentor Magazine

Global Exhibition Revenues Approaching Pre-Pandemic Levels

Trade shows and exhibitions are recovering nicely this year, with 2023 revenues expected to hit 97% of 2019 levels.

Trade shows and exhibitions are recovering nicely this year, with 2023 revenues expected to hit 97% of 2019 levels.

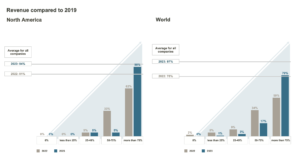

The global exhibition industry is bordering on a full recovery, according to the 2023 Global Exhibition Barometer, a biannual research report offering comprehensive insights into the current state of the exhibition industry conducted by UFI, the Global Association of the Exhibition Industry. This year, the global exhibition industry anticipates hitting 97% of 2019 levels on average. This is a big bump up from 2022, when the global average was 78% of 2019 levels. In fact, recovery is actually exceeding expectations — just six months ago, exhibition companies were anticipating a 91% recovery.

In North America, which for UFI’s purposes include the U.S. and Mexico, exhibition revenues are anticipated to hit 94% this year, up from 81% in 2022. Operating profits are doing even better, with 63% reporting an increase of more than 10% this year over last, compared to 55% saying the same worldwide. Another 31% report stable growth, with just 6% saying they have seen a deficit of 11% to 50%. Overall, 68% said that the quick bounce back to business as usual means that the pandemic actual has confirmed the value of face-to-face events.

However, UFI’s survey also found that challenges remain. Chief among those for U.S. exhibition companies are internal management, at 19%. The impact of digitization also is an issue for 17% of U.S. companies, and competition with other media is challenging 16% of those surveyed. The state of the economy in the home market also is still causing headaches for 15%, while 13% are worried about global economic developments. Of much smaller concern was competition from within the exhibition industry and sustainability/climate issues, both of which were cited by just 7%. In a good sign for pandemic recovery, just 3% said the impact of COVID-19 was still an issue for their businesses.

Upcoming challenges U.S. exhibition and trade show organizers have on their radars include changing customer expectations (64%), staffing (68%), digitization (50%), and deglobalization (27%). Of lesser concern, but still on their list, were climate-related regulations (18%) and diversity, equity and inclusion-related regulations (14%).

Upcoming challenges U.S. exhibition and trade show organizers have on their radars include changing customer expectations (64%), staffing (68%), digitization (50%), and deglobalization (27%). Of lesser concern, but still on their list, were climate-related regulations (18%) and diversity, equity and inclusion-related regulations (14%).

Digitization Dilemmas

As many discovered over the course of the pandemic, exhibitions don’t translate well to a digital format. In fact, 73% said virtual events would definitely not be replacing physical events, compared to just 9% who thought virtual probably would take over the current role of physical events. They were a little less sure about the future role of hybrid events, with 36% saying they probably would be a factor and 32% saying they weren’t sure, while just 14% said they most likely would. And that holds true for international events as well as domestic, UFI found. Forty-one percent said there would definitely not be fewer international in-person exhibitions or overall fewer participants.

But that doesn’t mean exhibition organizers are giving up on digitization, UFI found. For example, 64% intend to add digital services and products — think apps, digital advertising and digital signage — around their existing exhibitions. Another 41% are changing their internal processes and workflows from analog to digital, while another 36% are developing a digital/transformation strategy for their entire organization.

Smaller percentages are getting more granular with their digitization efforts, including developing digital/transformation strategies for individual exhibits and products (18%), creating a designated upper/top management role such as Chief Digital Officer (14%), and launching digital products that are not directly related to their existing exhibitions (36%).

AI Edging In

U.S. exhibition organizers also are thinking about how to use generative artificial intelligence (AI) applications such as ChatGPT to improve their operations. Among the top AI applications they believe will affect the industry are sales, marketing and customer relations; research and development; event production; human resources; and finance and risk management.

The next UFI Global Exhibition Barometer survey will take place in January 2024. Download the full 2023 report here.

Free Subscription to

MeetingMentor Online

"*" indicates required fields

About ConferenceDirect

About MeetingMentor